What Is Union Budget 2023?

The Union Budget of India is presented every 1st February of the year that’s why it is also called Annual Financial Statement. The union budget is always presented by the finance ministry of India. In this budget year 2023, India has borrowed 15.4 lakh crore to boost the GDP of India.

In this year 2023, the Union budget has been presented by Nirmala Sitharaman (Minister of Finance). This budget is focused on many fields such as the automobile sector, railway sector, agriculture sector, MSME sector, education sector, research sector, and many other sectors.

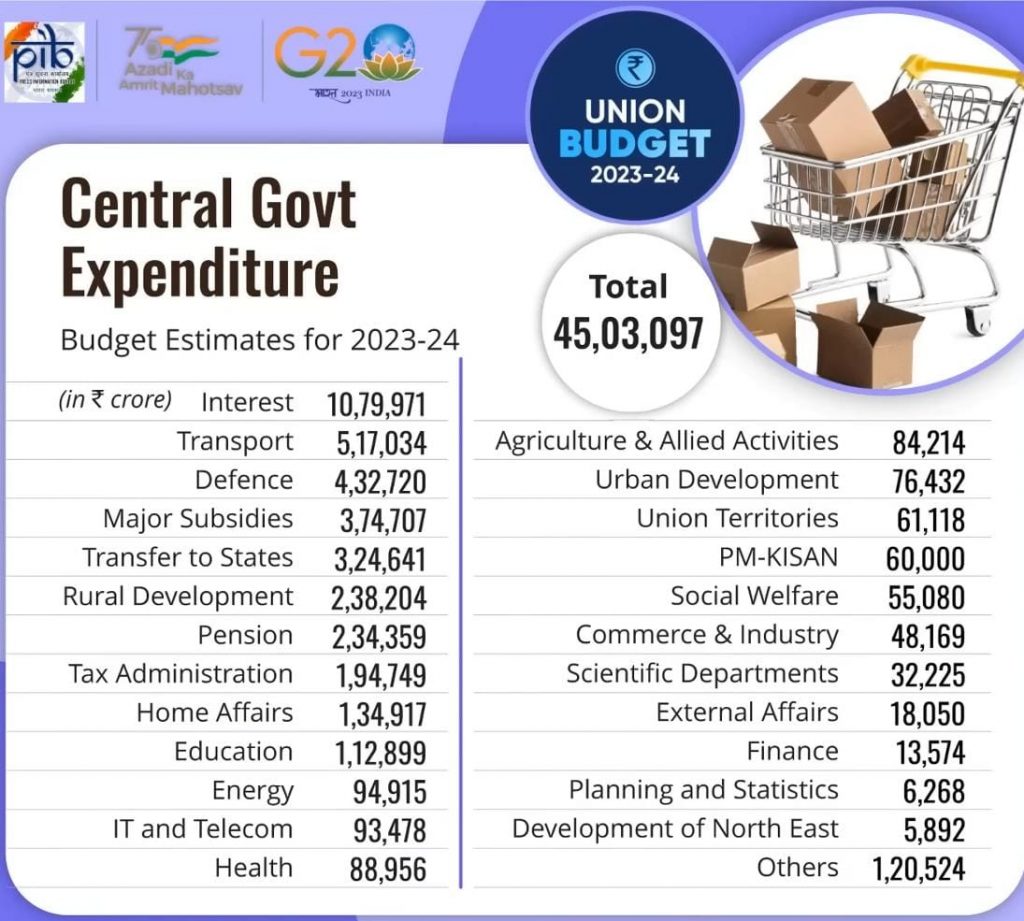

In the Union Budget 2023, India will be spending 45 lakh crore or 550 billion dollars to boost the Indian economy.

Let’s see more about Union Budget 2023: Highlights, Tax Slab & All Information.

What Gets Cheaper in Union Budget 2023?

- Customs duty on parts of open cells of TV panels cut to 2%.

- Govt proposes to reduce customs duty on the import of certain inputs for mobile phone manufacturing.

- Govt to reduce basic customs duty on seeds used in the manufacturing of lab-grown diamonds.

- Govt to reduce customs duty on shrimp feed to promote exports.

What Gets Costlier in Union Budget 2023?

- Taxes on cigarettes hiked by 16 %.

- The basic import duty on compounded rubber increased to 25 % from 10 %.

- Basic customs duty hiked on articles made from gold bars.

- Customs duty on kitchen electric chimney increased to 15 % from 7.5 %.

- The government plans to introduce a 5 percent compressed biogas mandate for all entities marketing natural gas in India. This may mean that companies marketing natural gas in India will have to market compressed biogas, or CBG, to the extent of 5 percent of their volumes.

- The government has been pushing for increased production of CBG and its blending with natural gas, particularly in the transportation segment that uses compressed natural gas CNG, as a fuel.

Union Budget 2023 Tax Slab

- The income of Rs 0-3 lakh is nil.

- Income above Rs 3 lakh and up to Rs 5 lakh is to be taxed at 5 % under the new regime.

- Income of above Rs 6 lakh and up to Rs 9 lakh are to be taxed at 10% under the new regime.

- Income above Rs 12 lakh and up to Rs 15 lakh to be 20% under the new regime.

- Income above Rs 15 lakh is to be taxed at Rs 30%.

New Tax Regime in Union Budget 2023

- FM Sitharaman proposes to increase the income tax rebate limit from Rs 5 lakh to Rs 7 lakh in the new tax regime.

- Govt to enhance grievance redressal mechanism for direct taxpayers.

- An individual with an annual income of Rs 9 lakh will have to pay only Rs 45,000.

- No tax for income up to Rs 3 lakh; 5 percent tax on Rs 3-6 lakh, and the highest tax rate of 30 % on income above Rs 15 lakh under the new tax regime.

- An individual with an income of Rs 15 lakh will have to pay Rs 1.5 lakh tax, down from Rs 1.8 lakh under the new tax structure.

- Govt to provide a higher limit of Rs 2 lakh per member for cash deposits and loans by Primary Agricultural Credit Societies.

- Govt proposes to reduce the highest surcharge rate from 37 % to 25 % in the new regime.

Union Budget 2023 Custom Duty

- Govt. to reduce customs duty on shrimp feed to promote exports: FM Sitharaman.

- Taxes on cigarettes hiked by 16 percent

- Basic import duty on compounded rubber increased to 25 percent from 10 percent.

- Basic customs duty hiked on articles made from gold bars.

- Customs duty on kitchen electric chimney increased to 15 percent f 7.5 percent.

- Customs duty on parts of open cells of TV panels to 2.5 percent

- Govt proposes to reduce customs duty on the import of certain inputs for mobile phone manufacturing.

Union Budget 2023 in Education Sector

In this financial year, 2023 India will be spending ₹112899 crores on the education sector.

100 labs for developing apps using 5G services will be set up in engineering institutions.

To realize the new range of opportunities, business models, and employment potential, labs will cover among others, apps such as smart classrooms, precision farming, intelligent transports systems, and healthcare announced FM Sitharaman.

Union Budget 2023 Fiscal Deficit

The Union Budget has fixed the fiscal deficit target for 2023-24 at 5.9 percent of GDP. This would represent a reduction of 50 basis points from this year’s fiscal deficit target of 6.4 percent, which Finance Minister Nirmala Sitharaman said would be met.

Next year’s target is in line with economists’ expectations of 5.9 percent. However, some questions have been raised – particularly by global rating agencies like Moody’s Investors Service and Fitch Rating about how the medium-term target of 4.5 percent will be met by 26.

Union Budget 2023 Saving

- One-time, new savings scheme for women with a tenure of two years to offer a 7.5% interest rate with a partial withdrawal option.

- For senior citizens, the maximum deposit limit for saving will be from 15 lahks to 30 lakh rupees.

- Investment limit in small savings schemes like Senior Citizen saving schemes (SCSS) increased to Rs 30 lakh from 15 lahks earlier.

- The investment limit in the Monthly income scheme (MIS) increased to rupees 9 lahks, up from rupees 4.5 lahks, for a single account. For joint accounts, the limit has gone up to Rs 15 lakh, up from Rs 9 lakhs.

Union Budget 2023 MSMEs

Revamped Credit guarantee scheme for MSMEs will take effect from 1 April 2023 with the infusion of Rs. 9000 crores into the corpus the FM says. effect.

This will enable an additional collateral-free credit guarantee of Rs. 2 lakh crore rupees, which will enable to lower the cost of credit by a percent. Good news for MSMEs that are still recovering from the impact of a pandemic.

Union Budget 2023 Auto Sector

FM Sitharaman says: Replacing old government vehicles will provide a fillip to the economy. It would translate into growing order books of auto companies increasing output and creating jobs. this was last done in India on a mass s around 2008 after the Lehman brother’s collapse.

Union Budget 2023 Transportation

In this financial year 2023, India will be spending ₹517034 crores on the Transportation sector.

The government’s focus on capex and infrastructure development is evident from the current Budget. This will provide several lending and investment opportunities. For example, an allocation of Rs 75,000 crore towards transport infrastructure projects will aid in the transformation of this sector and attract more investments.

Further, the deployment of Rs 10,000 crore in an Urban Infrastructure Development Fund for creating infrastructure in Tier 2 and Tier 3 cities will create more opportunities for investment in these towns.”

Union Budget 2023 Agriculture

In this budget 2023, India will be spending ₹84214 crores on the agriculture and allied activities sector. Agriculture Credit Target to be raised to Rs 20 lakh crore.

Finance Minister Nirmala Sitharaman said: ” Agriculture Credit Target will be increased to Rs 20 lakh crore, with focus on animal husbandry, dairy, and fisheries, the minister said, adding that a new sub-scheme of PM Matsya Sampada Yojana will also be launched with a targeted investment of Rs 6,000 crore.”

FAQ About Union Budget 2023

Q. Who presented the Union budget 2023?

Ans. Nirmala Sitharaman (Minister of Finance).

Q. What increase in budget 2023?

Ans. Visit: targetstudy.in

Q. Will income tax slab change in 2023?

Ans. Yes.

Q. How long budget speech 2023?

Ans. Updating Soon.

Q. What is Union Budget 2023?

Ans. Visit: targetstudy.in

Q. When Union Budget 2023 will be presented?

Ans. 1 Feb 2023.

Q. What is Union Budget?

Ans. Visit: targetstudy.in